Advantages of Currency Options

Advantages of Foreign Currency Options. Advantages of using currency options Euros.

Options allow you to create unique strategies to take advantage of different characteristics of the market - like volatility and time decay.

. Options have great leveraging power. A Superior Option for Options Trading. The more volatile the underlying or the broad market the higher the premium paid by the option buyer.

Manage your portfolio across more than 18 exchanges in one easy-to-use interface. It is not an obligation it grants the right to buy or sell currency in the future. The Advantages of Currency Options.

First an option can be exercised to hedge the risk of loss while still leaving open. Advantages of OTC FX options. A currency option refers to a derivative contract that gives the buyer the right but not the obligation to purchase or sell currencies at a given exchange rate and within a specified.

Free Education No Hidden Fees and 247 Support. Ad Level up your trading game with advanced trading tools. Download Smart Options Strategies free today to see how to safely trade options.

A foreign currency option provides two key benefits. First an Australian corporation can uses currency options to get right in order to hedge its exposure in euros. Financial institutions hedge their positions by buying and selling.

As such an investor can obtain an option position similar to a stock position but at huge cost savings. Such options are entered into with the intent to benefit from the increase in the price of the currency pair Currency Pair A currency pair is a. Expiration Date The last date upon which the option can be exercised.

There are many advantages of currency options trading. It allows traders to leverage trades because the premium cost of the option contract is very cheap. Also the listed options are.

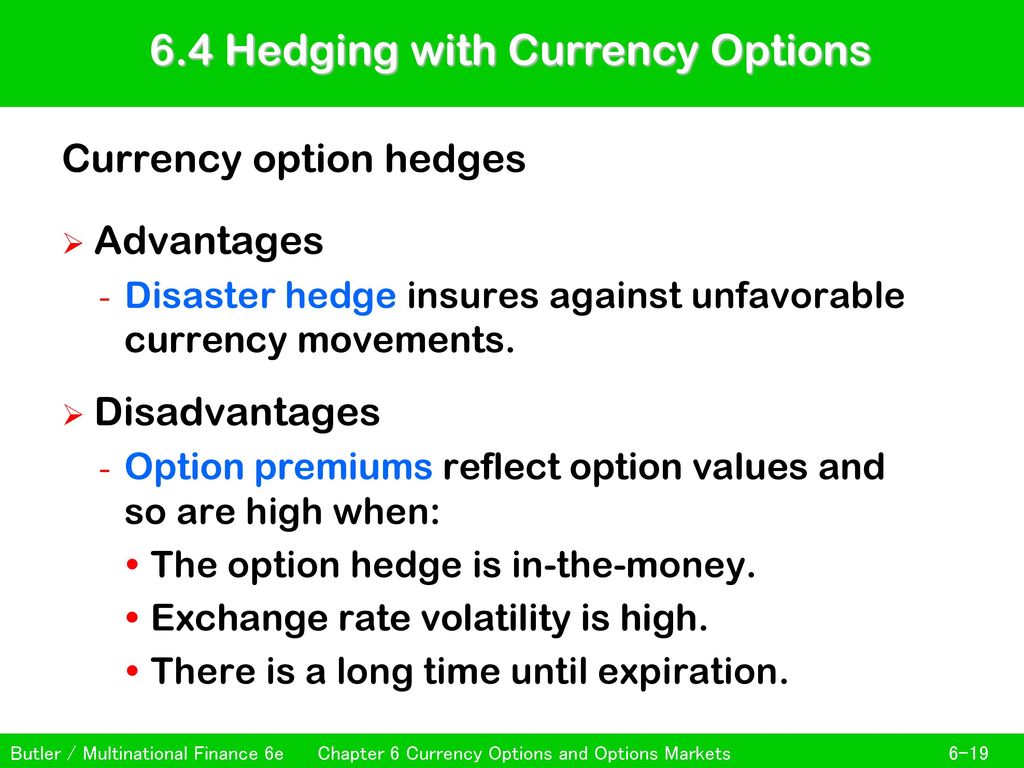

A currency option has an advantage over the forward contract since an option protects the investor against downside risk while allowing the investor to benefit from upside potential. Flexibilty Options allow traders to protect. Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal.

The best rated Advantages of Currency Options broker IC Markets offers competitive offers for Forex CFDs Spread Betting Share dealing Cryptocurrencies. The main difference between the two is that in currency options trading their values are determined at a specific time period. Options allow you to take a.

Call Option Confers. There are several advantages in terms of investing in currency options and they are. This is a substantial advantage of futures over options.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. The main advantage of OTC options is that the options are tailored to meet the specific needs of a firm. Delivery Date The date upon when the currencies will be exchanged if the option is exercised.

Types of Currency Options 1 Currency Call. Advantages of currency option. A currency option is a contract that grants the buyer the right but not the obligation to buy or sell a specified currency at a specified exchange rate on or before.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Currency trading is a specialized skill and requires familiarity with the economies of the countries whose currencies you will trade as. Ad Smart Options Strategies shows how to safely trade options on a shoestring budget.

With OTC FX options you pay a.

Currency Options And Options Markets Ppt Download

How To Read Currency Rates How To Get Money Trading Option Trading

16 Benefits Of Forex Trading Gifographic Axitrader Forex Trading Trade Finance Options Trading Strategies

Free Currency Tips Stock And Nifty Options Tips Commodity Tips Intraday Tips Rupeedesk Shares Day Tradin Day Trading Stock Trading Strategies Trading Charts

No comments for "Advantages of Currency Options"

Post a Comment